In the fast-paced world of Forex trading, the advent of technology has revolutionized how traders execute their strategies. One such innovation is the Forex trading bot. These automated systems allow traders to trade on their behalf, ensuring that opportunities are seized even when they aren’t able to monitor the market. If you’re new to this concept, or if you already have experience, this article will delve into the intricacies of Forex trading bots, helping you understand their benefits and offering advice on choosing the most suitable one for your trading style. To make informed decisions, it’s crucial to partner with forex trading bot Trusted Trading Brokers as you navigate this landscape.

What is a Forex Trading Bot?

A Forex trading bot is a software program that automatically executes trades on the Forex market based on predefined strategies. These bots analyze market data, implement trading signals, and manage open positions without the need for human intervention. The primary objective of using a trading bot is to minimize the emotional aspect of trading, which can often lead to poor decision-making during volatile market conditions.

Benefits of Using Forex Trading Bots

The popularity of Forex trading bots has surged over recent years, and for good reason. Here are some advantages:

- Emotionless Trading: Bots operate based on algorithms, eliminating emotional factors from trading decisions.

- 24/7 Market Access: Forex markets are open 24 hours a day. Bots can monitor the market and execute trades at any time, even when you are sleeping.

- Speed and Efficiency: Trading bots can analyze vast amounts of data and respond to market changes much quicker than a human trader.

- Backtesting: Most trading bots allow you to backtest your strategies on historical data before applying them in real-time, helping you refine your trading approach.

- Consistency: Bots follow the same strategy consistently, reducing the chances of erratic decisions characteristic of manual trading.

How to Choose the Best Forex Trading Bot

With numerous trading bots available in the market, choosing the right one can be overwhelming. Here are key factors to consider:

1. Performance and Reliability

Before selecting a Forex trading bot, research its performance metrics. Check user reviews and testimonials to gauge its reliability. A trustworthy bot should have a track record of consistent profitability.

2. Customization Options

Look for bots that offer high customization options. This allows you to tweak settings according to your risk appetite and trading style, enabling you to maximize your potential rewards.

3. Security Features

Since Forex trading involves financial transactions, it’s crucial to ensure that the bot has robust security features to protect your data and funds. Look for bots that use encryption and offer two-factor authentication.

4. Customer Support

Check if the bot provider offers reliable customer service. Responsive support can be a game-changer during emergencies or technical issues.

5. Compatibility

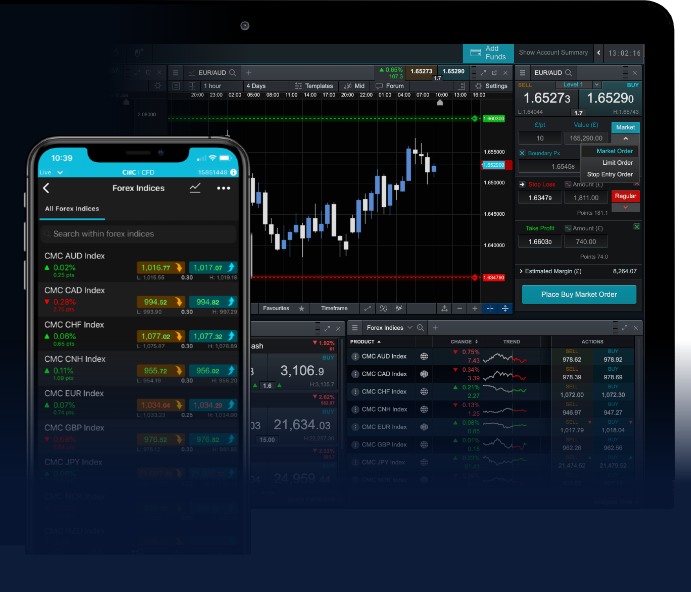

The bot should be compatible with your trading platform. Popular platforms include MetaTrader 4 and MetaTrader 5, so ensure the bot can integrate seamlessly with your preferred choice.

Key Strategies for Successful Automated Trading

Even though Forex trading bots operate independently, you still have a role to play in ensuring their success. Here are several strategies to help you along the way:

1. Regular Monitoring

Even though the bot executes trades on autopilot, regular monitoring is essential. Keep an eye on its performance to catch any irregularities or misbehaviors early.

2. Continual Optimization

Market conditions fluctuate, and so should your strategies. Regularly optimize your trading algorithms based on current market conditions and past performance.

3. Diversification

Don’t rely solely on one trading bot or strategy. Diversifying your investments can help minimize risk and enhance potential returns.

4. Set Realistic Expectations

While trading bots can be incredibly effective, they are not a magic solution for guaranteed profits. Set realistic expectations about your potential returns and be prepared for market fluctuations.

Conclusion

Forex trading bots have transformed the trading experience, allowing both novice and experienced traders to automate their strategies and potentially increase their profitability. While they offer numerous advantages, it’s vital to conduct thorough research and select the right bot that aligns with your goals. Remember, successful Forex trading, even with a bot, requires regular monitoring, optimization, and a solid understanding of market dynamics. By leveraging technology and maintaining an informed perspective, you stand a better chance of succeeding in the vibrant world of Forex trading.